Partners

2020

Since 2020

$85B

Over $85B trading volume

420+

420+ clients

50+

50+ DEXs and CEXs

$2,5B

Total Cap of Our Clients is $2,5B

BPX M.M Introduction

What Is Market Making

Conventional market making brings buyers and sellers together to create a marketplace for stocks and other securities. Market makers are high-volume investors that “create a market” by quoting

to buy and sell an asset simultaneously

This practice ensures that a market maker is reaaily available to buy or sell an asset themselves should there be no natural buyer or seller. As a result, market makers act as buyers and sellers of

last resort. Market makers profit on the spread between the bid and ask prices and provide crucial liquidity services to the broader market. Liquidity refersto the ease with which an asset can be bought or sold without affecting price stability

Market makers and Liquidity services

Adequate liquidity stands to benefit all stakeholders, as it helps make financial markets more efficient by reducing price volatility and supporting fair prices. Market liquidity is dependent on order books – the collection of active buy and sell orders for a particular market. The difference between the highest bid price and the lowest sell price is known as the bid-ask spread.

Markets with low liquidity will often have a wide bid-ask spread, which is typically indicative of low volume. Conversely, more liquid markets often have a tighter bid-ask spread and higher volume. Market makers actively facilitate liquid markets by posting tighter spreads.

Market makers will often buy and sell securities for their accounts and post prices to an exchange platform with the goal of generating profit on the bid-ask spread.

The bid-ask spread is how much the asking price exceeds the bid price; the difference generates a profit for the market maker. The fee compensates market makers for the risk they assume when they buy and hold assets that decline in value after purchase, but before resale.

Who Are Market Makers?

The speed and ease of trading stocks continues to improve – especially since the advent of app based investing. Through a pp-based platforms, users can execute trades within seconds, depending on the type of market order. However, behind the scenes, it’s market makers that help to ensure that this process occurs efficiently. The most common type of market makers are brokerage houses that offer purchase-and-sale services to investors. These brokerages aim to keep financial markets liquid while also generating a profit for themselves.

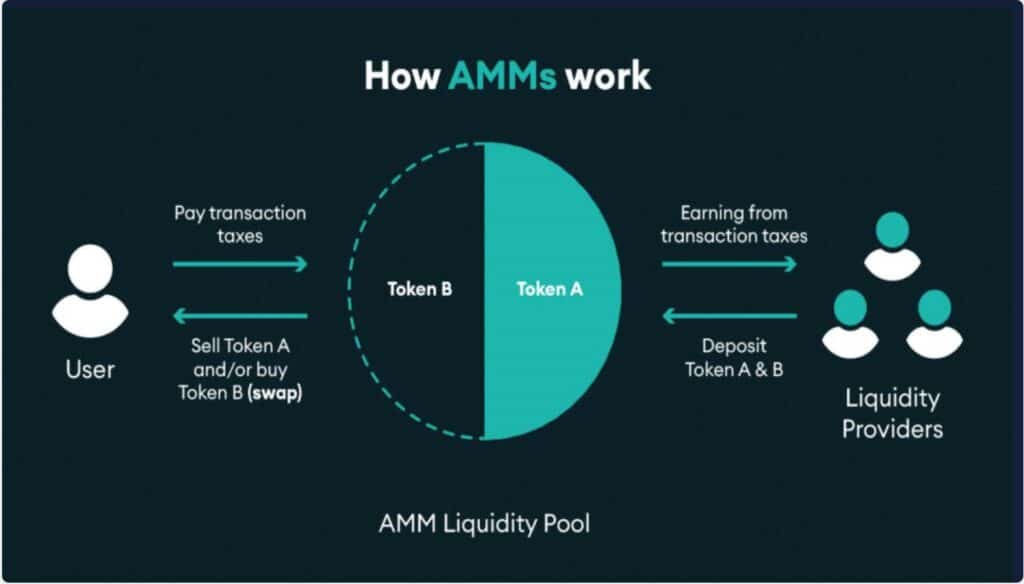

Automated Market Makers (AMM)

Unlike today, the earliest market makers didn’t have the luxury of automation. It wasn’t until the early 1990s that Shearson Lehman Brothers and ATD first implemented automated market makers (AMMs).

Before this, order books were the product of manually initiated trades meant to improve market liquidity. This manual approach to market making caused slippage and price discovery latency, while the lack of transparency led to accusations of market manipulation.

AMMs solved these problems by removing humans from the market-making process, which also near-instant trades and greater transparency

How does Crypto Market Making Work?

Market making consists in providing liquidity on a defined cryptocurrency by submitting both bid and ask limit orders on a crypto exchange. Market makers make profit by collecting the bid-ask spread over multiple trades. A fast and stable technology and proper risk management are essential to make markets succesfully.

What are the benefits of crypto market making?

Markets that have low liquidity will generally have wide bid-ask spreads in their order books that can increase the volatility of the asset. Therefore it makes it more difficult for traders to get a good price for their trade and have their orders filled. The overall liquidity of a market greatly influences its growth, and market makers play a big role in ensuring liquidity. Simply stated, the liquidity of an asset is its availability for buyers and sellers to easily trade it at any given time.

The benefits of creating a crypto market making

1

Increases market liquidity and order book depth

2

Reduces price volatility

3

Assists with fair price discovery

4

Dramatically reduces slippage

BPX market making

BPX Crypto Currency has launched market making (M.M) in its lasted achievement. At our core, There are market-making experts.

As a leading global market maker, BPX generates deep liquidity hat helps to create more efficient markets around the world.

Our liquidity is powered by innovative, proprietary technology and designed to automate market making and post-trade processes.

The chart below shows an example of Phoenixbot activity

Safety and Security

The robot will straight connect to the API and nothing will happens to the asset of the M.M account of customer, no harms for the customer’s wallet and its liquidity because of no manual connection between us and the PhoenixBOT to the wallet.

Our servers contain the highest levels of safety and security with Measured on an international scale and used by multiple secure systems.

Strategy

PhoenixBot contains several strategies with exlucive methods for customers, it will create wonderful and attractive chart for absorbing users to your project, for example in the while that price is increasing BOT will start putting sale orders to increase the liquidity of your M.M account to bring you the income.

Support

BPX M.M team will provide 24h support In the 7 days of week for its service in the Common Telegram group with the head administration of the costumer team.